Justice is priceless.

But we judge ourselves based on results.

Let’s get to work.

On any given day, the people of Ruiz & Smart are speaking with clients, authoring pleadings, drafting discovery, taking depositions, working with experts, speaking at seminars relating to our work, mediating, hammering out the details of settlements, or in trial.

We show up, take on the insurance companies, and put people first.

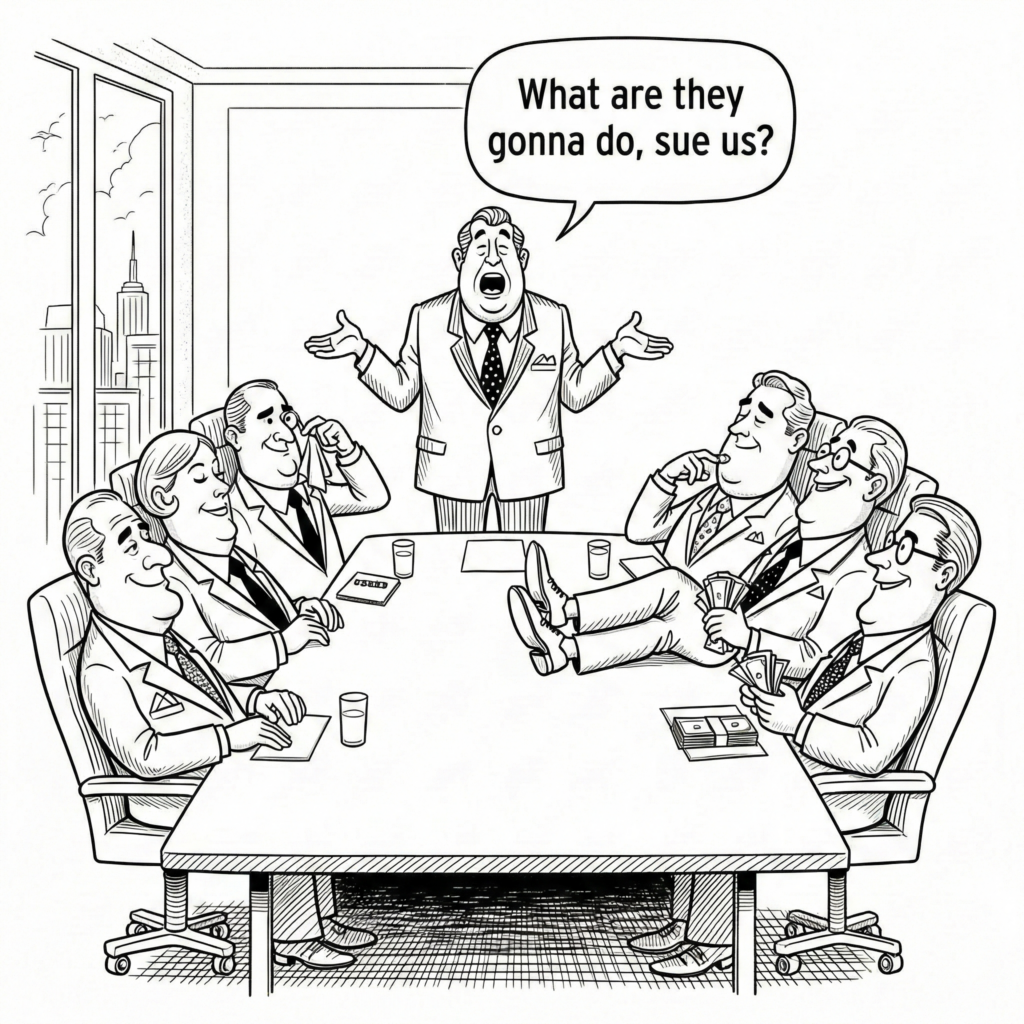

The insurance company is counting on you not getting legal help.

When an insurance company lowballs, delays, or otherwise betrays a policyholder, it’s almost always the result of policy decisions made at high levels at the company.

More and more claims departments are infected with bad culture, poor training, and zero accountability. Adjusters are given far more claims than they could possibly investigate in a full or fair fashion.

In most cases, insurance companies get away with it because people don’t know their rights or there’s something holding them back from calling an attorney.

Remember: The insurance company knows it makes more money when you don’t look for help.

You’re not alone.

The Insurance Fair Conduct Act?

Ruiz & Smart trial lawyer Isaac Ruiz wrote the book on it—literally.

His book helps lawyers across the state seek justice in court on behalf of policyholders, including many with serious injuries.

Chapter 1 is available for you to read here.

What is insurance bad faith in Washington?

Insurance bad faith occurs when an insurance company fails to act reasonably, honestly, and fairly toward its policyholder. In Washington, insurers have a legal duty to put the policyholder’s interests on equal footing with their own. When an insurer unreasonably delays, denies, or underpays a claim—or conducts an unfair investigation—it may be acting in bad faith.

Is insurance bad faith illegal in Washington?

Yes. Washington has some of the strongest insurance consumer protections in the country. Insurers are regulated by statute, administrative rules, and court decisions that require fair claim handling. When insurers violate these duties, policyholders may have legal remedies beyond the policy benefits themselves.

What kinds of insurance claims can involve bad faith?

Bad faith can arise in many types of claims, including auto insurance (UIM/UM), homeowners insurance, renters insurance, disability insurance, life insurance, and commercial policies. Any situation where an insurer mishandles a claim may potentially involve bad faith.

What are common examples of insurance bad faith?

Common examples include unreasonable delays in investigating or paying a claim, denying coverage without a valid explanation, misrepresenting policy language, ignoring evidence supporting the claim, repeatedly requesting unnecessary documentation, or forcing a policyholder to sue to receive benefits that should have been paid voluntarily.

How long can an insurance company take to decide a claim?

Washington regulations require insurers to promptly investigate and communicate about claims. In general, an insurance company must complete its investigation of a claim within 30 days, but the regulations allow additional time if reasonably needed.

While there is no single deadline for every situation, long unexplained delays can be evidence of bad faith—especially when the insurer has sufficient information to make a decision.

What if the insurance company keeps changing the reason for denial?

Shifting explanations are a significant red flag. An insurer should identify all coverage issues early and explain them clearly. Changing rationales over time may indicate that the insurer is looking for reasons to deny rather than conducting a fair evaluation.

What is an unfair claims settlement practice?

Washington law prohibits specific unfair practices, such as failing to adopt reasonable standards for claim handling, not attempting in good faith to settle claims where liability is reasonably clear, and compelling policyholders to litigate by offering substantially less than what is ultimately owed.

Can I sue my own insurance company for bad faith?

Yes. Unlike many legal disputes, bad faith claims are often brought against your own insurer. If the insurer violates its duties, policyholders may pursue legal action to recover damages caused by the unfair conduct.

What damages can be recovered in a Washington bad faith case?

Depending on the circumstances, damages may include unpaid policy benefits, financial losses caused by delay, emotional distress damages, attorney’s fees, and—in some cases—treble damages.

What are the Consumer Protection Act (CPA) and the Insurance Fair Conduct Act (IFCA), and how do they relate to bad faith?

Washington’s Consumer Protection Act and Insurance Fair Conduct Act are two separate laws.

The CPA prohibits unfair or deceptive practices in trade or commerce, including insurance practices. A successful CPA claim can allow recovery of attorney’s fees and potentially enhanced damages, which gives insurers strong incentives to comply with the law.

IFCA prohibits an insurance company from unreasonably denying coverage or payment of benefits. A successful IFCA claim can allow recovery of the unpaid benefits, emotional distress, attorney fees, and punitive damages up to three times the actual damages you sustained. The punitive damages under IFCA are sometimes called “treble damages.”

Do I have to prove the insurance company acted intentionally?

No. Bad faith does not require proof of malicious intent. The standard is reasonableness. Even negligent claim handling can constitute bad faith if it falls below what a reasonable insurer would do under similar circumstances.

What if the insurer eventually pays the claim—can it still be bad faith?

Yes. An insurer can act in bad faith even if it ultimately pays benefits, if the payment comes only after unreasonable delay, pressure, or improper conduct that harmed the policyholder along the way.

What is a reservation of rights (ROR) letter?

A reservation of rights (ROR) letter notifies the policyholder that the insurer is investigating or providing a defense while reserving the right to deny coverage later. These letters should be taken seriously and reviewed carefully, as they can significantly affect coverage rights.

Should I give a recorded statement to my insurer?

Policyholders often must cooperate with reasonable requests, but recorded statements can be used to dispute claims. These requests should be handled carefully, and in some situations legal advice is appropriate before giving a statement.

Can delays alone amount to bad faith?

Yes, if the delay is unreasonable under the circumstances. Insurers are expected to move claims forward diligently. Extended silence, repeated postponements, or failure to respond to communications can support a bad faith claim.

What if the insurer keeps asking for more documents?

While insurers can request relevant information, repeated or unnecessary requests can be a tactic to delay payment. The reasonableness of the requests and their timing are important factors.

How does bad faith differ from a simple coverage dispute?

A coverage dispute focuses on whether the policy applies. Bad faith focuses on how the insurer handled the claim. An insurer can lose a coverage dispute without acting in bad faith, or commit bad faith even where coverage is debatable.

What evidence is important in a bad faith case?

Claim files, correspondence, internal insurer notes, timelines, and expert testimony on claim handling practices are often critical. Documentation by the policyholder is also extremely important.

Do I need a lawyer to pursue an insurance bad faith claim?

Bad faith claims are serious matters and insurer-defended. Insurers have experienced legal teams and significant resources. Experienced legal representation helps ensure that unfair practices are identified and properly challenged.

What is the biggest mistake policyholders make when dealing with bad faith?

The most common mistake is assuming the insurer will eventually “do the right thing” if they wait long enough. In reality, unreasonable delay often continues until there are real consequences. Understanding your rights early can prevent prolonged harm.